The SA Reserve Bank’s Monetary Policy Committee decided on Thursday to again keep the repo rate unchanged at 8.25%, amid a struggling economy and inflation that is still not in the ideal range that the SARB would like to see.

This leave the prime interest rate at 11.75% – the highest in 15 years.

But there may be some hope that a rate cut will be on the cards after the next MPC meeting in September, as two members preferred a reduction of 25 basis points during the July MPC meeting this week. However, they were outnumbered as four members preferred an unchanged stance.

In discussing the stance, the four MPC members agreed that restrictive policy remains appropriate to stabilise inflation at 4.5%. The other two members, however, were of the view that the inflation outlook had improved enough to reduce the degree of restrictiveness.

Inflation has been slow and stubborn to cool. The most recent headline inflation, for May, was 5.2%, unchanged from April and still in the top half of the SARB’s target range.

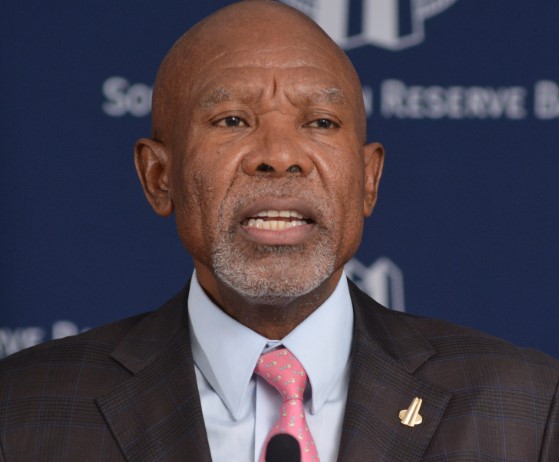

Governor Lesetja Kganyago says the outlook has however improved somewhat.

Headline consumer price inflation for this year is now projected at 4.9%, compared to 5.1% at the previous meeting. Over the next few quarters, headline is expected to dip below the 4.5% midpoint, mainly because of fuel and food prices. This outlook is supported by the stronger rand. The implied starting point for our forecast is now at R18.35 to the US dollar. Over the medium term, we continue to see inflation stabilising at 4.5%, with core inflation remaining close to this midpoint objective throughout.

Kganyago says inflation expectations are also moving in the right direction, but they continue to show the impact of the recent inflation surge.

We are committed to stabilising inflation at the mid-point of the target band. Achieving this outcome will improve the economic outlook and reduce borrowing costs.

Kganyago has also reiterated the views of the Committee that additional measures are needed to improve economic conditions. ”These include reaching a prudent public debt level, improving the functioning of network industries, lowering administered price inflation, and keeping real wage growth in line with productivity gains.”