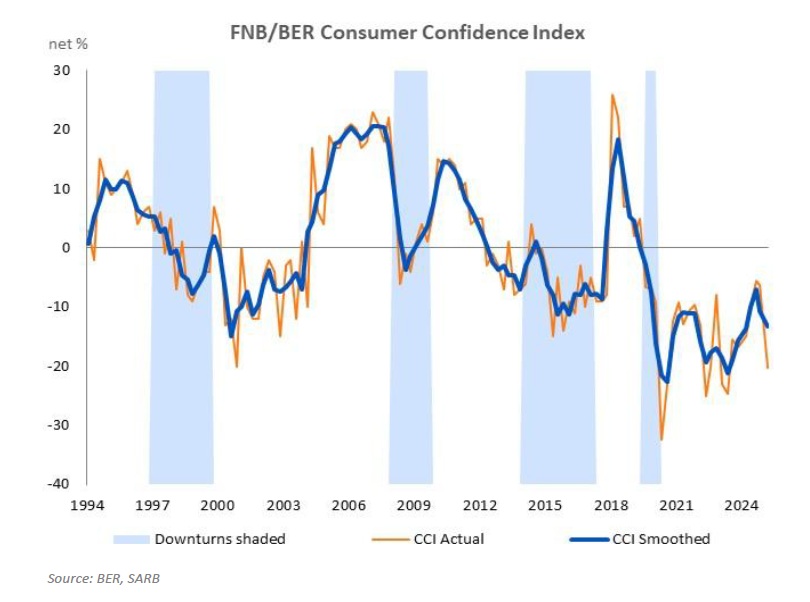

South African consumer confidence took a major knock in early 2025, with the FNB/BER Consumer Confidence Index (CCI) plunging from -6 to -20 points in the first quarter.

This sharp decline reflects growing concerns over potential tax hikes and economic uncertainty.

The confidence drop came shortly after the Finance Minister’s proposed two-percentage-point VAT increase surfaced in February, sparking concerns about higher taxes.

Although the final budget softened the VAT hike to a smaller increase over two years, consumers are still feeling the pressure, even as it remains to be seen whether the smaller increase will be approved.

ALSO READ: Parliament’s Budget Office NOT in favour of VAT hike

The lack of inflation adjustments to income tax brackets and medical aid tax credits for the second consecutive year has further dampened financial outlooks, especially for high-income earners.

In addition to tax concerns, worsening diplomatic relations between South Africa and the U.S., along with the global trade wars under U.S. President Donald Trump, have contributed to economic uncertainty.

The brief return of Stage 6 load-shedding in early 2025 also played a role in the decline of consumer confidence. The last time confidence dropped this drastically was during the first quarter of 2023, when South Africa first faced severe power outages.

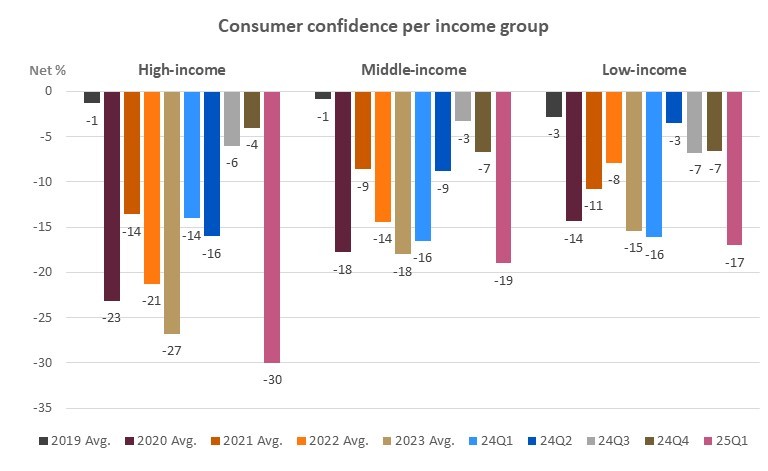

Consumer confidence fell across all income groups, with high-income households (earning over R20,000 per month) seeing the biggest drop, from -4 to -30 points.

Middle-income earners (R5,000 to R20,000) and low-income earners (under R5,000) also saw declines, dropping to -19 and -17 points, respectively.

After a strong end to 2024, where consumer spending grew by 2.3%, experts now predict a slowdown. FNB Chief Economist Mamello Matikinca-Ngwenya pointed to factors like reduced retirement fund withdrawals, rising global uncertainty, and diplomatic tensions as key concerns.

“The biggest hit to consumer confidence likely came from tax proposals and uncertainty within the government,” she said.

While low-income households may benefit from increased social grants and an expanded zero-rated VAT basket, high-income consumers—who have the greatest spending power—will feel the tax pinch the most.

The decline in their confidence raises further concerns about the economic outlook.

For years, consumer spending has been the driving force behind South Africa’s economy.

From 2015 to 2024, real consumer spending grew by 11.2%, while overall GDP (excluding consumer spending) remained stagnant. This latest confidence drop signals trouble ahead, as consumers face a combination of rising inflation, high interest rates, and increasing taxes.

While some analysts believe the steep drop in confidence could be an overreaction—especially since the proposed VAT hike was reduced—the overall outlook for consumer spending remains bleak.