All eyes are on the Reserve Bank’s Monetary Policy Committee, who are expected to announce an interest rate cut on Thursday afternoon at 15:00.

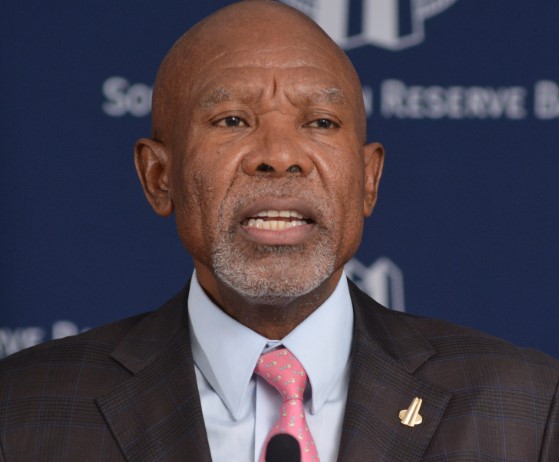

Most economists are of the view that Reserve Bank Governor Lesetja Kganyago will announce a 25 basis point reduction in the repo rate to 8%, which will bring the prime lending rate (interest rate) to 11,5%.

It comes after consumer price inflation fell to its lowest level in three years.

Statistics South Africa announced Wednesday that inflation fell to 4.4% in August, compared to 4.6% in July.

Contributing factors to the decrease in inflation were transport (fuel), housing, restaurants and hotels, although food price inflation ticked up again, after 8 months of decline.

The Chief economist at the Efficient Group Dawie Roodt says the lower inflation numbers, coupled with the fact that the US Federal Reserve cut USA rates by 50 basis points on Wednesday night, does open the door for Kganyago to be bold and cut rates by 50 basis points.

But he says the notoriously Hawkish Reserve Bank Governor is likely to decide on a more conservative 25 basis point cut, but at the same time open the door to further cuts in November and early next year.

Median forecasts show consumers could see cumulative cuts of a 100 basis points until May 2025, which will push the repo rate down to 7,25% – and the interest rate to 10,75% – to provide much needed relief to those in debt.

It is still far above November 2021 levels, when the rate hike cycle began. Since then rates have increased by 475 basis points, reaching the highest levels in 15 years.