As annual consumer inflation cooled for a fourth consecutive month to 3,8% in September (down from 4,4% in August), a local economist believes there is scope for the South African Reserve Bank to cut the repo rate by 50 basis points, but that the MPC will likely remain conservative by only allowing a 25 basis point reduction.

Inflation is now at its lowest level since March 2021, when the rate was 3,2%, and it’s currently well below the SARB’s mid-range target of 4,5%, which makes a strong case for a more aggressive repo rate cut.

But the lead economist at KPMG Frank Blackmore says there are two reasons why the Monetary Policy Committee will likely opt for a 25 basis point: Rates are not that far above a sustainable level for South Africa and the risk that inflation will again rise sharply is still there, given the current geopolitical landscape.

Blackmore explains South Africa’s repo rate is only about 1,25% above where it should be over the longer term, while Europe and the USA are still a long way off before they reach sustainable interest rate levels.

Thus the SARB will be a lot more cautious in its approach.

In addition, the only real reason inflation fell so sharply in September is due to lower transport costs, brought about by a stronger rand and lower international oil prices.

The transport category entered deflationary territory for the first time in 13 months, with the annual rate falling from 2,8% in August to -1,1% in September. Fuel prices dropped for a fourth successive month and are on average 9,0% lower than a year ago.

But Blackmore says the reverse can happen just as quickly, and fuel prices can increase sharply again.

Conflict in many parts of the world, especially uncertainty in the Middle East and fears over a broader regional war will ensure the risk-averse Reserve Bank Governor Lesetja Kganyago will stick to a modest 25 basis point repo rate cut.

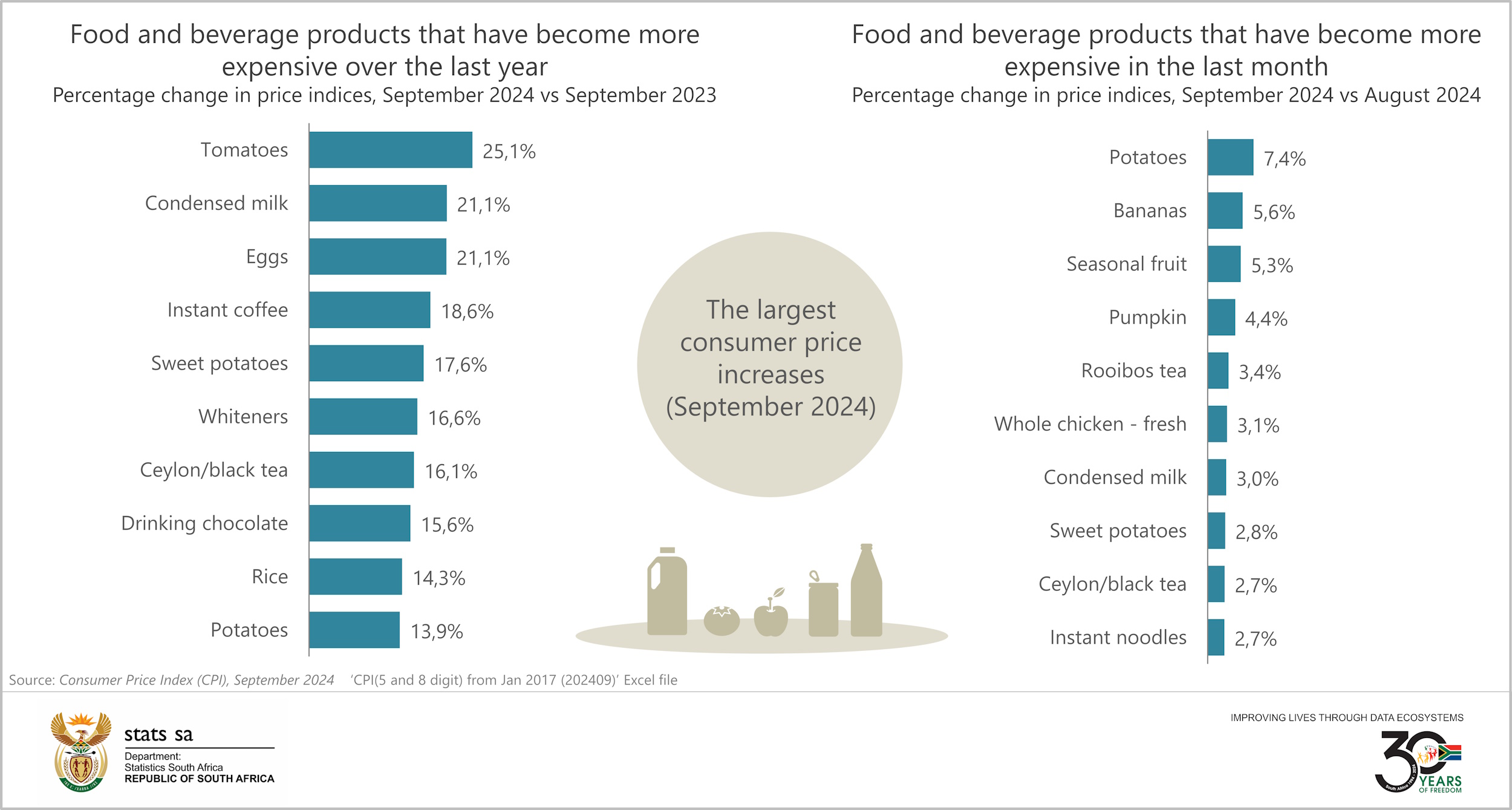

Annual food inflation remained unchanged from August, with several products that became more expensive between August and September.

If the MPC cuts rates by 25 basis points on 21 November 2024, the interest rate with decline to 11,25% (repo 7,75%).

READ: Interest Rates have been cut, more relief on the way