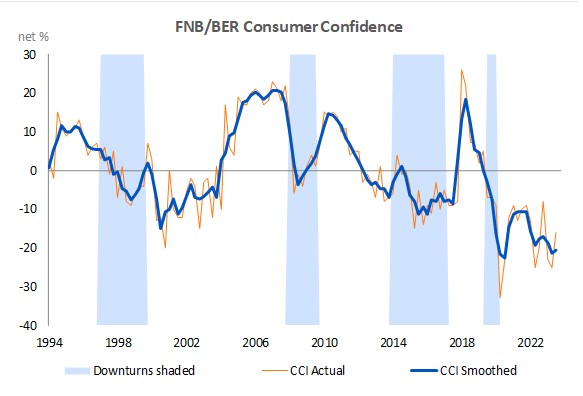

After nosediving from -8 index points during the fourth quarter of 2022 to -25 by the second quarter of 2023, the FNB/BER Consumer Confidence Index (CCI) rebounded to -16 index points in the third quarter of 2023.

The reading of -25 recorded during the second quarter of 2023 equaled the second-lowest Index reading on record since 1994, with -36 (logged during the hard COVID-19 lockdown in 2020Q2) being the historical low for the FNB/BER CCI.

Despite the 9-index point rebound in the third quarter, the latest reading of -16 remains well below the long-run average CCI reading of zero since 1994, signalling a low willingness to spend among consumers.

The recovery in the CCI during the third quarter of 2023 can largely be ascribed to a strong rebound in the economic outlook sub-index of the CCI and an improvement in the time-to-buy durable goods sub-index.

The economic outlook sub-index jumped by 15 index points to -22, while the index measuring the appropriateness of the present time to buy durable goods (e.g. vehicles, furniture, household appliances and electronic goods) improved by 9 index points to -26. The household financial outlook sub-index of the CCI only ticked up by 1 index point to -1.

All three sub-indices remain well below their long-term average readings, but consumers remain more concerned about the outlook for the national economy compared to their own household finances.

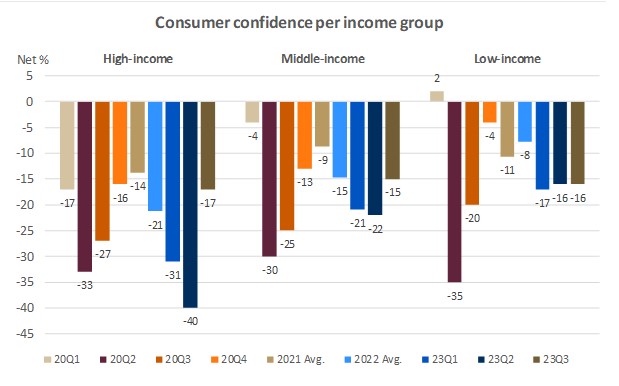

A more detailed breakdown of the CCI shows a remarkable rebound in the confidence levels of high-income households (earning more than R20 000 per month) following an outsized decline during the first half of 2023.

Spooked by a dramatic escalation in load-shedding, a sharp depreciation in the rand exchange rate, successive interest rate hikes and the diplomatic fallout following the docking of a Russian ship in Simon’s Town, affluent consumers became particularly alarmed about South Africa’s economic prospects.

High-income confidence plunged to an all-time low of -40 in the second quarter of 2023, but rebounded to -17 in the third quarter.

The confidence levels of middle-income households (earning between R5 000 and R20 000 per month) also improved, from -22 to -15, during the third quarter.

Low-income confidence (earning less than R5 000 per month) remained unchanged at -16 index points.

Whereas high-income households were considerably more pessimistic than low- and middle-income households during the first half of 2023, the confidence levels of all three income groups are once again at similar (relatively depressed) levels.

FNB Chief Economist Mamello Matikinca-Ngwenya said:

“While the financial pulse of the nation remains weak, there appears to be some light at the end of the tunnel for consumers. The CPI inflation rate cooled from 7.1% in March 2023 to 4.7% in July, fueling hopes that the South African Reserve Bank has reached the end of its interest rate hiking cycle. Combined with a sustained recovery in employment – with another 154 000 jobs added during the second quarter – lower inflation should bolster the purchasing power of consumers somewhat towards the end of 2023. An unexpected and noticeable easing in load-shedding during the survey period, coupled with reduced dependency on Eskom by households that invested in alternative power supply sources, and diminishing concerns around South Africa’s diplomatic relations with the West likely also heartened consumers.”

These positive developments seemed to outweigh the impacts of confidence-sapping events such as the torching of multiple trucks on the N3 transport corridor in July, the damaging week-long taxi strike in the Western Cape during August, and the ongoing municipal worker strike in Tshwane.

FNB says a sustained moderation in inflation – especially in food prices – should start to relieve some of the pressure on retail sales volumes from the fourth quarter, with projected interest rate cuts providing greater impetus to consumer spending by mid-2024.

ALSO READ: Consumer inflation lowest in two years