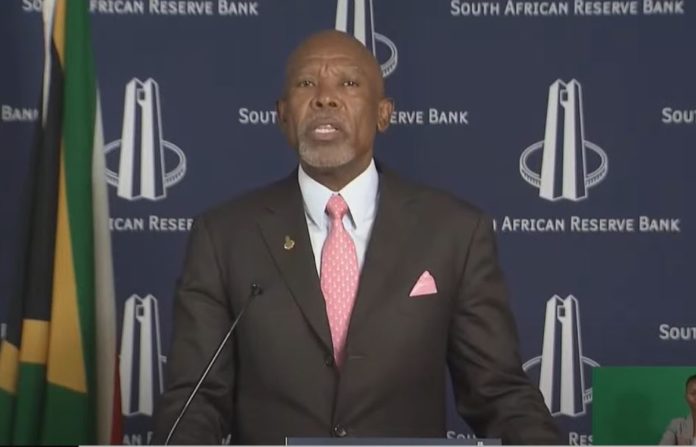

South African Reserve Bank (SARB) Governor Lesetja Kganyago has announced that the repurchase rate (repo rate) has reached 7.75% after the Bank’s Monetary Policy Committee (MPC) agreed to a 50 basis points increase.

As a result, the prime interest rate will now move up to 11.25%.

Kganyago announced this at a press briefing on Thursday afternoon.

“The revised repurchase rate is now less accommodative and is more consistent with the current view of risks to inflation. The aim of policy is to anchor inflation expectations more firmly around the mid-point of the target band, and to increase confidence of attaining the inflation target sustainably over time.

“Guiding inflation [currently at least 7%] back towards the mid-point of the target band [between 3% and 6%] can reduce the economic costs of high inflation and enable lower interest rates in the future. Achieving a prudent public debt level, increasing the supply of energy, moderating administered price inflation and keeping wage growth in line with productivity gains would enhance the effectiveness of monetary policy and its transmission to the broader economy,” Kganyago said.

The SARB has raised the repo rate at least six times in a row, as South Africa’s economy continues to recovery slowly from global volatility and the long standing effects of the COVID-19 pandemic.

The Governor said the Bank expects economic growth to remain constrained.

“The South African economy contracted by 1.3% in the fourth quarter of 2022, considerably worse than expected at the time of the January meeting. The contraction was broad-based, consistent with the extensive load shedding experienced in the final three months of the year. For the whole of last year, GDP growth of 2.0% was achieved, compared to the 2.5% previously expected.

“For 2023, the Bank’s forecast for GDP growth is lowered slightly to 0.2% from the 0.3% expected in January. As a result of extensive load shedding and logistical constraints, the supply performance of the economy remains severely impaired,” he said.

Despite these factors, Kganyago said some growth is expected to be achieved in 2024 and 2025.

“Over the forecast period, we expect household spending and investment to grow modestly, even as load shedding and uncertainty continue to weigh heavily on consumption and investment decisions. Private sector investment is expected to remain positive, in large part reflecting efforts to overcome constraints in energy and transport supply.

“As a result of these factors, the economy is forecast to expand by 1.0% in 2024 and by 1.1% in 2025,” he said.

Kganyago would not say whether the rate hiking cycle has come to an end, listing several factors that may influence future decisions.

ALSO READ: Interest rate hikes heading for its peak