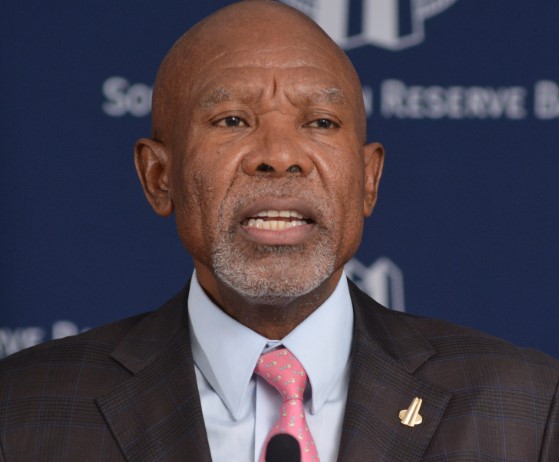

Highly indebted consumers and businesses should brace themselves for interest rates to stay higher for longer, as sticky inflation remains a concern for the South African Reserve Bank’s Monetary Policy Committee, under the leadership of governor Lesetja Kganyago.

It was hoped that the repo rate would be lowered either in January or March 2024, and some economists are now pinning their hopes on rates to be cut in either July or September 2024, but the possibility of rates being lowered at all this year is now fading fast, as expressed in the Reserve Bank’s six-monthly monetary policy review, released towards the end of April.

The worry is that inflation – which came in at 5.3% in March – is not slowing down fast enough.

The Reserve Bank is sticking to its policy that CPI must be as close to the midpoint of its target band as possible – that’s 4.5% – but the expectation is that this will not happen until the fourth quarter of 2025.

What’s more, Kganyago has expressed the view that he would like to see a much lower inflation target of 3%, but the central bank and treasury are in the process of determining a new target.

Various risks to inflation, such as rising oil prices, have become a reality in the last few months, which the Reserve Bank describes as “setbacks” suggesting that the road to 4.5% is “likely to be bumpy and protracted”.

In addition, it is expected that food price inflation will also start to rise again due to the impact of the drought caused by El Niño.

The weaker rand also pushes up the inflation of imported products.

In addition, the US Federal Reserve decided on Wednesday – late evening South African time – to also keep the interest rate unchanged in America.

This decision, which was widely expected, means that it is highly unlikely that the Reserve Bank will lower the interest rate in South Africa on 30 May.

The Reserve Bank has kept the interest rate unchanged for almost a year now.

In the past five meetings of the MPC, the repo rate has been kept at 8.25%, which pins the prime interest rate of banks at 11.75%.

The prospect that high interest rates will remain for longer will be great news for those who have savings and investments, but serves as a caution to consumers to reduce their debt as soon as possible.

ALSO READ: Consumers continue feeling the pinch as repo rate unchanged